Digital Nomad Health Insurance: Is SafetyWing Worth It Vs Others in 2026?

/One of the biggest question I get as a digital nomad is: “How do you manage your health expenses while constantly travelling, especially when you’re hiking, cycling or doing something adventurous?”

It’s an important question and I just want to say, when you live a nomadic life, your routines become unpredictable and sometimes you can’t control every single thing.

I recently went on a solo hiking trip to Nepal, and I could really feel the altitude.

There were moments when I should’ve slowed down or gotten checked, but instead I tried to tough it out mainly because I didn’t want to spend too much money upfront and had skipped on travel insurance (which in reality was a terrible idea, please don’t do that!).

When I started looking at insurance options online, I was honestly shocked. Most of them cost so much money, especially for something that are only covered emergencies and nothing beyond that.

I’ve tried multiple insurance options over the years ranging from local providers in my home country to generic travel insurance policies. And I learned that most traditional plans are either too restrictive and simply not designed for a life on the move.

So, I finally ditched the “winging it” approach and decided to get serious about digital nomad insurance. After some research this year, I bit the bullet and landed on SafetyWing.

Also read: The Best Trekking Travel Insurance For Nepal & Beyond (+ Adventure Sports)

What “Proper” Digital Nomad Insurance Really Means?

When I say “comprehensive,” I’m talking about more than just emergency medical coverage. In my experience, a truly useful plan should include:

Everyday medical care: Routine check-ups, vaccinations, and ongoing care for long-term conditions. This is something many digital nomads overlook. Just because you’re on the move doesn’t mean you can ignore health maintenance.

Dental and mental health care: Yes, I know dental emergencies abroad can be a nightmare, and mental health is just as important as physical health especially when you’re living a transient lifestyle.

Home medical coverage: One of the things I found frustrating with other insurance providers is that many exclude treatment in your home country or limit it severely. For me, this is non-negotiable. I want to know that if I need treatment at home, I’m fully covered.

The fact that wellness and massage therapy are even included blows my mind! With SafetyWing’s Nomad Insurance Complete plan, you’re actually covered for 15 visits per policy year at up to US$60 per visit for a wide range of therapies from chiropractors, massage therapists, osteopaths, and podiatrists to dieticians, homeopaths, acupuncture, and even treatments from recognised Traditional Chinese or Ayurvedic practitioners.

For people like me, long-term digital nomads who occasionally return home, this kind of coverage has been perfect because now I don’t need to get double insurance plans which was such a headache!

Why I Chose SafetyWing?

here is why i think this could be the best digital nomad health and travel insurance: safetywing

In 2026, one of the options I see most nomads using is SafetyWing. But is it really worth it? My experience has been that it’s a solid choice for certain lifestyles. Here’s my breakdown:

Pros

Global Coverage: SafetyWing is designed for people who move frequently and covers 175+ countries. As someone hopping between Asia, Europe, and the US, I need coverage that adapts to wherever I am without constantly updating my policy.

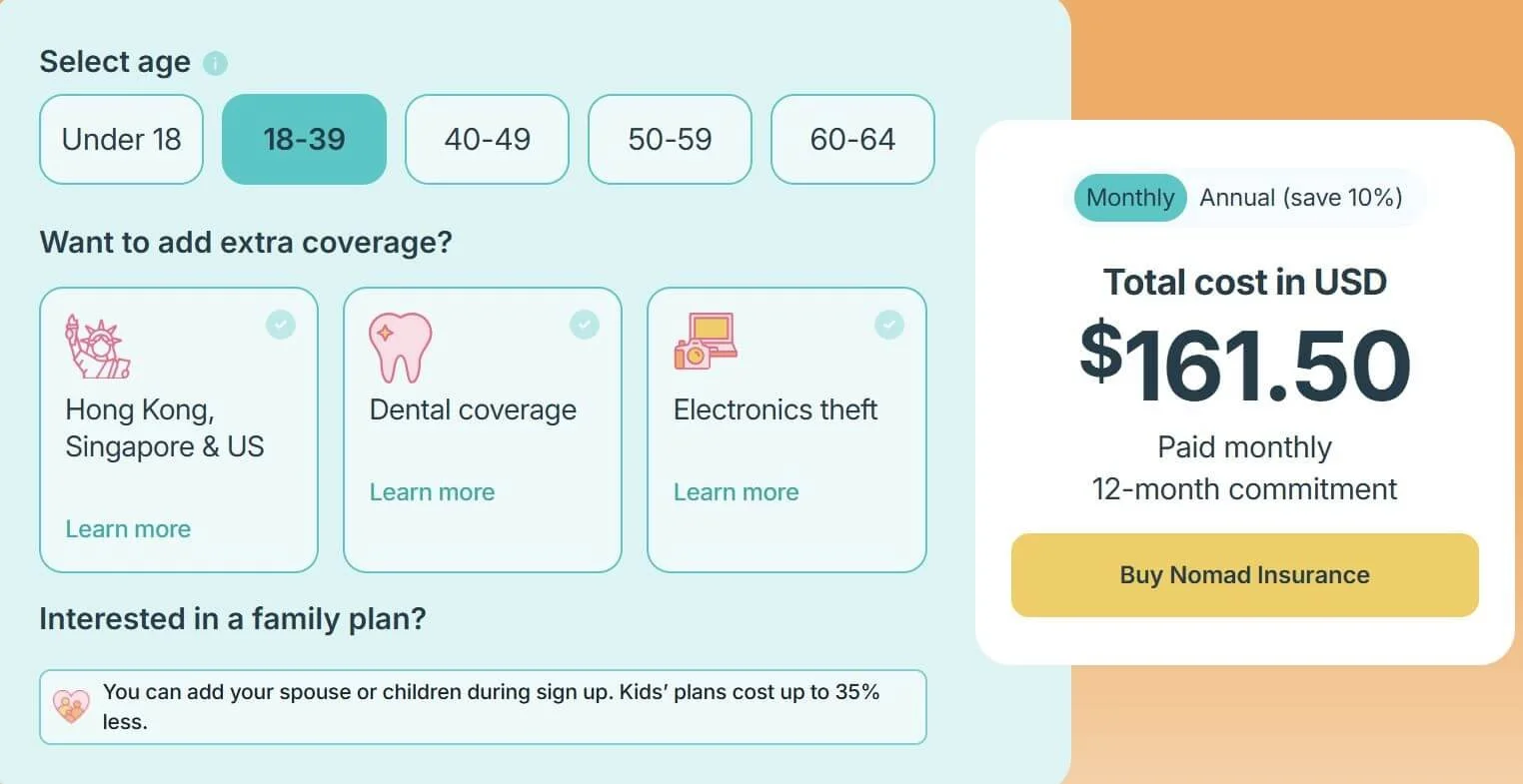

Affordable Premiums: For a full-coverage Nomad Complete Insurance Plan, SafetyWing’s pricing is very competitive. For US$161.50, you get a very very comprehensive plan. It will cover you if you do develop long-term health issues like diabetes, cancer or asthma while you’re on the plan for however many years. It also has important coverage for preventative or routine care such as annual check-ups, screenings, vaccines, and maternity care.

High coverage limit: The maximum coverage limit is US$1.5 million per policy annually which is very generous!

Emergency Coverage: For sports and adventure, the Nomad Complete Insurance Plan covers all kind of adventurous activities. Whether it’s a trekking fall in Nepal or a cycling crash in Kyrgyzstan. SafetyWing covers emergencies and hospitalisations without absurd deductibles.

Making claims are easy: Some Reddit users bemoan that their claim process takes time but I beg to differ. As an official insurance provider, SafetyWing process has been simplified and takes 2 minutes to submit your claims online and everything is settled within 10 working days. They even have an online chat function to assure you if you’ve any queries!

Cons

Doesn’t cover pre-existing illnesses: While it does not cover pre-existing conditions, it is renewable for life, and will cover you if you do develop long-term health issues like cancer or asthma while you’re travelling.

Singapore and Hong Kong aren’t covered as standard: Coverage in Singapore and Hong Kong is not included by default and typically requires an add-on or separate arrangement. If you spend extended time in either city, this is something you’ll need to factor into your decision.

SafetyWing vs Genki vs WorldNomads - How Do They Fare?

which digital nomad health insurance should you pick? Here’s how i compare safetywing vs genki traveler vs world nomads

Over the last few years, three names kept popping up in conversations with other nomads: SafetyWing, Genki Traveler, and World Nomads. Here’s how they compare based on what matters for my lifestyle and probably yours too if you’re serious about safety and budget.

| Provider | Best For | More Popular Because… |

|---|---|---|

| SafetyWing | Budget-conscious nomads & global coverage | Affordable, flexible, travel + medical combination |

| Genki Traveler | Health-focused long-term nomads | Higher medical limits and routine care option |

| World Nomads | Adventure travellers & activity-heavy trips | Strong activity and adventure sport support |

And what’s the rationale for choosing each one of these?

working remotely while being covered both at home and while i travel (the best!)

SafetyWing

I chose SafetyWing as my first choice because it just worked when I was already on the road and I found them to be a comprehensive global health insurance with travel benefits. Their Complete plans go beyond emergency-only travel insurance and include:

Emergency & non‑emergency medical coverage

Travel-related benefits like lost luggage, trip interruption, travel delays

Home country coverage for limited days each year

My simple pros and cons for each:

✅ Pros

Simple monthly subscription ($161.50 depending on plan/personal factors).

High coverage limit that goes up to US$1.5 million per policy annually which is very generous (as mentioned earlier)

Includes real travel benefits beyond health.

❗ Cons

Certain countries need to be added as an add-on

Pre-existing conditions generally excluded.

Genki Traveler

Genki is a newer option, but its focus on health-only coverage makes it less suited for digital nomads.

It doesn’t fully address many of the practical risks of life on the road, such as trip disruptions, mental health support, or coverage for adventure activities (all of which are hugely important for people like us!)

Here’s what stood out to me:

Higher medical coverage limits typically up to around €1,000,000 yearly

Covers inpatient and outpatient care, doctor visits, ambulance transport, and some dental and evacuation costs.

Routine medical care and preventive treatment are often included.

⚠️ Trade-offs

Monthly premium can be slightly higher than SafetyWing’s lowest tiers but only offers “medical only”

It’s more medical‑focused so travel perks like lost luggage or trip cancellation aren’t covered.

From my perspective, Genki is not ideal as it falls short when it comes to the wider range of risks nomads face on the road. It isn’t a fully comprehensive solution for those who travel frequently especially digital nomads.

World Nomads

World Nomads often gets recommended by travellers who spend a lot of time doing high‑risk activities such as mountaineering, skiing, biking, surfing (technically that should be for me!). At one point, I thought of taking this but the cost was INSANE $$$ and not ideal for me.

Its standout points:

One of the highest coverage limits out there (in the millions).

Activity and adventure support is huge either included or available with add‑ons.

Covers a wide range of travel needs, including gear and trip interruption.

However… because of all this:

It generally isn’t as budget‑friendly as SafetyWing or Genki.

It’s structured more like classic travel insurance with strong medical components meaning it can feel like health insurance, but with less depth for everyday care.

So how do you decide which digital nomad insurance is perfect for you?

You can use this calculator to check what works for you!

There’s no such thing as a “perfect” digital nomad health insurance. Every option comes with trade-offs, and what works best really depends on how you travel, how long you’re on the road, and what kind of risks you’re comfortable taking.

That said, after years of moving between countries, hiking in remote places, cycling long distances, and living in that in-between space of not fully settled but not just travelling either… I find myself leaning towards SafetyWing Nomad Complete Insurance Plan.

For me, I really like the combination of being covered at home (Malaysia) and travelling globally. In the future, if you want to build roots they also have an option that covers maternity and for you to include under your plan a spouse and/or children under 18 or 18-24.

It’s not your typical travel insurance. It feels like they actually get digital nomads especially those of us living in ever-changing situations, no matter which country we’re in.

So do the math, and decide what matters most to you. For me, having a plan that truly adapts to my lifestyle, whether at home or on the road is honestly the best kind of investment one needs!

Like this story? PIN IT!